Basic Approach to Climate-Related Information Disclosure

December 1, 2025

Towards the realization of a carbon neutral society, in August 2021, the KOKUSAI ELECTRIC Group endorsed the TCFD (Task Force on Climate Related Financial Disclosures) recommendations, and in April 2023, set a goal of reducing CO2 emissions in line with current pledges under the Paris Agreement to limit global warming to 1.5˚C.

We have reviewed the climate change related information disclosed in Octber 2024 in accordance with IFRS S2.

Governance

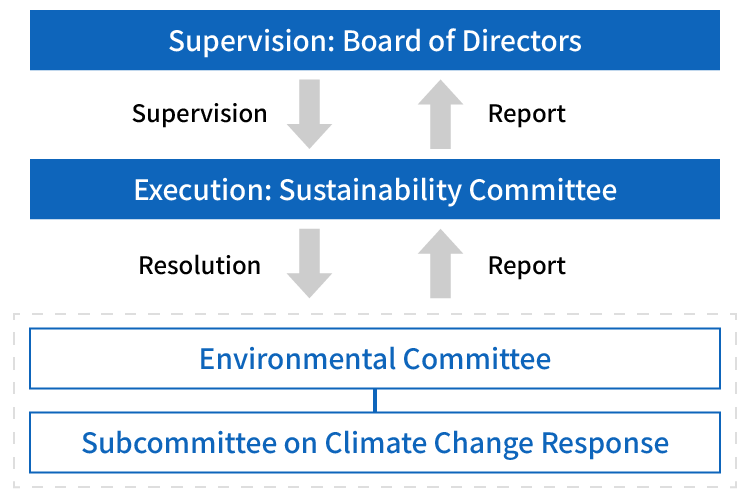

The KOKUSAI ELECTRIC Group's activities to address climate change are deliberated and decided by the Sustainability Committee, which meets regularly, chaired by the President and CEO, and then reported to the Board of Directors. The Board of Directors has the necessary knowledge, experience and capabilities to oversee climate change and oversees the Sustainability Committee to ensure the adequacy of the process.

The Climate Change Subcommittee identifies risks and opportunities related to climate change and reports them to the Sustainability Committee. The Sustainability Committee then deliberates on these risks and opportunities, along with other environmental issues, taking into account their impact on business continuity.

Based on the results of these deliberations, the Sustainability Committee makes decisions on CO2 emission reduction targets, renewable energy adoption targets, and participation in climate change initiatives such as the SEMI Semiconductor Climate Consortium and SBT certification.

Going forward, the Committee plans to deliberate on the introduction of an internal carbon pricing system, plans for achieving net zero emission. The matters deliberated by the Sustainability Committee are reported to the Board of Directors, which oversees the content of environmental targets related to risks and opportunities and monitors the progress of those activities.

Diagram of the governance system for climate change response (See Corporate Report for overall corporate governance)

Governance structure and roles

| Organization name |

Roles |

Members |

Frequency of events |

|---|---|---|---|

| Board of Directors |

Receives and supervises the results of the Sustainability Committee's deliberations and monitoring reports. |

Representative Director, Directors |

Once a month |

| Management Meeting |

Deliberate on important sustainability and ESG topics. |

President and CEO, Executive Officers |

Twice a month |

| Sustainability Committee |

The following topics will be deliberated and monitored:

|

President and CEO, Executive Officers, Division Chiefs, and Managers of Departments appointed by the President and CEO |

Twice a year |

| Environment Committee |

Report on the degree of achievement of environmental objectives and targets, as well as the results of external and internal audits, and confirm the appropriateness, validity, and effectiveness of the management system. Report on the status of risks and opportunities, such as compliance, environmental education, and the status of GHG emissions reduction activities, to the Environmental Chief Manager and obtain approval for future activity plans. |

Environmental Chief Manager, |

Twice a year |

| Subcommittee on Climate Change Response |

Based on the policies decided by the Sustainability Committee and the Environmental Committee, departments selected by the subcommittee will report on their GHG emissions reduction action plans and results. |

Executive Officer in Charge of the Environment, |

Twice a year |

Climate-related investments

The KOKUSAI ELECTRIC Group strives to protect the environment and mitigate climate change by actively investing in activities to reduce the environmental impact caused directly and indirectly by its business activities, as well as in research and development to promote the reduction of the environmental impact of its own products. Past climate-related investment status is disclosed on our website.

Linking climate change response to executive compensation

The KOKUSAI ELECTRIC Group is building a system in which management takes the lead in addressing climate change by incorporating the degree of target achievement for ESG items into the individual performance evaluation of executive compensation.

Strategy

Risks and opportunities expected in the future due to climate change have been identified by analyzing the following scenarios according to the TCFD recommendations.

| Reference scenarios |

SSP1-1.9 and SSP5-8.5 of Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report; WEO2020 and NZE 2050 of International Energy Agency (IEA) |

|---|---|

| Temperature scenarios |

1.5℃ scenario and 4℃ scenario |

| Scope of analysis |

KOKUSAI ELECTRIC Group and its entire value chain including both upstream and downstream activities |

| Time axis |

Short term: up to 2030 Medium term: up to 2040 Long term: up to 2050 |

| Risk/opportunity |

Expected future environment and impact on Group business |

|---|---|

| 1.5℃ scenario |

|

| 4℃ scenario |

|

Process for Identifying Risks and Opportunities Arising from Climate Change

In preparing to respond to impacts of climate change, we analyzed two different climate change scenarios and identified climate-related risks and opportunities. From a total of 189 risk and opportunity items extracted by relevant departments, 11 items with a particularly significant impact have been identified based on assessment of degree of interdependence and severity of impact.

The 11 items were assessed on a scale of small, medium, and large in terms of response measures and financial impact.

Main Climate-related Risks and Response Measures

Profit/cost: ↑ (profit) ↓ (cost)

Impact degree: ↑ (small) ↑↑ (medium) ↑↑↑ (large)

| Scenario | Risk/opportunity | Category | Risk tothe Group | Timing ofmanifestation | Value chain in which risk manifests | Impact onthe Group | Degreeoffinancialimpact | Responsemeasures●:In progress ▲:Scheduled |

|---|---|---|---|---|---|---|---|---|

| 1.5℃ | Transition risks | Laws andregulations |

|

Short to medium term | Upstream Direct operation |

Deteriorationof profit due tocarbon tax | ↓↓ | ● Promote introduction of renewable energy ▲ Promote reduction of CO₂ emissions by introducing internal carbon pricing ▲ Request supply chain members to replace the energy they use in manufacture and transport with renewables |

|

Medium term | Direct operation |

|

↓↓ | ● Scope 1 and 2: Introduce renewable energy ● Scope 3: Develop energy-efficient products | |||

| Market |

|

Short to long term | Direct operation | Deterioration of profit due to increase of development and manufacturing costs | ↓↓ | ▲ Facilitate evaluation and certification for application of alternative materials ▲ Expand application of alternative materials when developing new equipment | ||

|

Medium to long term | Direct operation | Deterioration of profit due to increase of development and manufacturing costs | ↓↓ | ● Update existing equipment to improve energy efficiency ● Reduce equipment operating time by improving operational efficiency | |||

| Evaluation |

|

Short to medium term | Downstream | Decline in evaluation by customers due to delay in response to environmental issues requested from the value chain | ↓ | ● Appeal the Group's environmental initiatives both internally and externally by actively participating in international consortiums ● Invest resource in ESG management (environmental measures) and expand information disclosure to customers and stakeholders | ||

|

Short to medium term | Direct operation Downstream |

|

↓↓↓ | ● Develop energy efficient technologies by strengthening collaboration with business partners ● Promote systems for environmental performance certification of own products | |||

| 1.5℃ | Physical risks | Chronic |

|

Medium to long term | Direct operation | Increase in power consumption leading to increased development and manufacturing costs and profit decrease | ↓ | ● Promote replacement to energy-efficient air conditioners ● Increase purchase of renewable energy and installment of PV generation systems |

| 4℃ | Acute |

|

Short to long term | Any part of the value chain | Operation of production sites may stop as a result of damage to buildings, affected employees, employees being unable to commute, and disruption of component supply caused by natural disasters | ↓↓↓ | ▲ Extract measures to ensure business continuity in case of abnormal weather events (decentralization of production sites, diversification of raw material suppliers, etc.) ▲ Quickly develop business continuity plans and measures in case of a disaster (formulate action guidelines for floods and massive snowfall, formulate a procurement strategy to minimize procurement risks, etc.) |

Main Climate-related Opportunities and Response Measures

Profit/cost: ↑ (profit) ↓ (cost)

Impact degree: ↑ (small) ↑↑ (medium) ↑↑↑ (large)

| Scenario | Risk/opportunity | Category | Opportunitiesforthe Group | Timing ofmanifestation | Value chain in whichopportunitymanifests | Impact on the Group | Degreeoffinancialimpact | Responsemeasures●:In progress ▲:Scheduled |

|---|---|---|---|---|---|---|---|---|

| 1.5℃ | Opportunities | Market |

|

Medium to long term | Upstream | Improvement in the level of environmental technologies of business partners | ↑ | ▲ Incorporate new technologies by strengthening collaboration by forming alliances with newcomers or through M&A |

| Product/service |

|

Short to long term | Downstream | Developmentof productsleveragingenergyefficienttechnologieswill befacilitated,leading toincrease insales | ↑↑↑ | ● Promote research and development of environmentally friendly products with good energy efficiency performance and high use rate of recycled materials ● Expand sales by developing high value-added products with superior energy efficiency compared to competitor products | ||

| 4℃ | Resilience |

|

Short to long term | Downstream | Heightened demand from customers for semiconductor manufacturing equipment with high automation capability to respond to business continuity challenges | ↑↑↑ | ● Develop semiconductor manufacturing equipment with high automation capability so that customer processes can be operated by a small number of people even during disasters |

Climate-related risk and opportunity analysis

Risk analysis and resilience assessment

In a decarbonized society where climate change countermeasures are strengthened, we believe that transition risks include the introduction of a carbon tax, CO₂ emission restrictions due to legal reforms, rising metal material costs due to rising energy costs, and increased requests for information disclosure from customers.

Of these, in response to the carbon tax and CO₂ emission regulations, we are working to reduce our greenhouse gas emissions by promoting the introduction of renewable energy, reviewing our parts procurement and product transportation methods, and continuously improving the energy-saving performance of our products.

Furthermore, in response to increasing customer requests for information disclosure, we are actively participating in international environmental consortia and constantly updating our environment-related disclosure information in accordance with the latest guidelines. Because we are promoting these measures in a planned manner, we believe we have a certain level of resilience.

On the other hand, in terms of physical risks, we anticipate abnormal weather and natural disasters, and as countermeasures we are promoting measures such as upgrading to energy-efficient air conditioning equipment, updating water recycling systems, decentralizing production bases, diversifying raw material suppliers, and formulating guidelines for action in the event of a disaster. As a result, we believe we have secured a certain level of resilience.

Opportunity Analysis and Outlook

In a decarbonized future society with enhanced climate control measures in place, it is assumed that more new players will enter the sector of low carbon product and energy-efficient equipment development, increasing chances to strengthen collaboration through alliances and M&A. It is also expected that there will be increased demand from customers for low carbon products and recycled materials. To meet such needs, we will promote development and sales of environmentally friendly products with added environmental value.

Physical risks associated with climate change may include the need to move production sites due to rising sea levels and frequent infection outbreaks making it difficult to secure sufficient manpower across the entire manufacturing industry. These factors accelerating demand for labor saving solutions and automation, together with increased demand for AI in various fields including climate change prediction and monitoring of the natural environment, are projected to result in increased demand for semiconductor devices.

To meet these needs, we will strengthen our capacity to provide the market with semiconductor manufacturing equipment with high energy efficiency and automation capability.

Risk Control

The KOKUSAI ELECTRIC Group has extracted and is considering responses to risk factors that will have significant impact on its business operations.

Based on analysis and assessment of both urgent climate-related risks and potential risk factors that may manifest in the future, we have devised measures to mitigate such risks and incorporated them in our business plan.

For those risks that have been identified as particularly important, relevant departments have set up a project team to ensure early response.

Metrics and Targets

In addition to promoting energy saving and the introduction of renewable energy, the KOKUSAI ELECTRIC Group operates a system that certifies products that excel in reducing environmental impact as environmentally friendly products. We endeavor to achieve the following targets in order to contribute to the reduction of greenhouse gas (GHG) emissions in society.

We received SBTi certification*2 by the Science Based Targets initiative (SBTi)*1 in March 2024, confirming that our GHG emissions targets are based on scientific grounds.

In April 2025, we joined RE100*3, aiming to convert the electricity used in our business activities to 100% renewable energy.

| Metrics |

Targets |

|

|---|---|---|

| ① |

Reduction of GHG emissions as a result of own energy use (Scopes 1 and 2) |

Target 50% reduction of GHG emissions by fiscal 2030 (compared with fiscal 2021) |

| ② |

Reduction of GHG emissions through products sold (Scope 3 Category 11) |

Target 52% reduction of GHG emissions per wafer by fiscal 2030 (compared with fiscal 2021) |

| ③ |

Increasing the proportion of renewable energy used by the company (Scope 2) |

Convert all electricity used at our sites to 100% renewable energy by fiscal 2030. |

- *1

-

International initiative that supports companies to set science based targets for reduction of GHG emissions

- *2

-

Five to ten year targets for GHG emission reduction set by companies in line with the level agreed in the Paris Agreement

- *3

-

An international initiative that aims to convert the electricity used in business activities to 100% renewable energy.

The amount of GHG emissions and the progress towards achieving targets are disclosed on our website.